How Much Money Do You REALLY Need To Buy A House?

How Much Money Do You REALLY Need To Buy A House?

If you’re trying to buy in Huntington Beach or anywhere in Orange County, the internet will usually tell you one of two extremes: you need 20% down… or you can buy with “almost nothing.” The truth is more practical (and more empowering): your total house buying costs depend on the loan program, your credit profile, your debt-to-income ratio, and how you structure the offer.

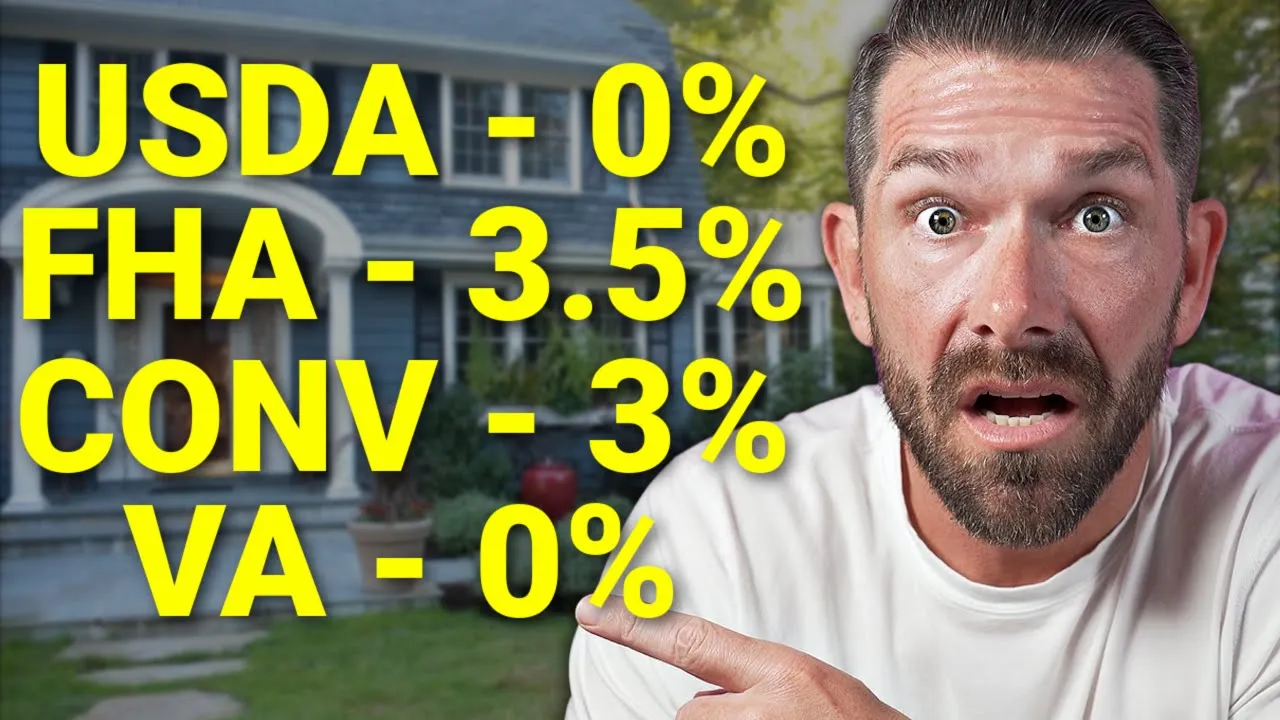

In this guide, we’re going to break down the real numbers behind minimum-down mortgage options—FHA, Conventional 3% down, USDA, and VA—and show you how to decide which one fits your situation best. The wrong choice can cost you thousands over time in payment, mortgage insurance, and flexibility. (That’s exactly why we made this episode.)

Quick note: This post is educational. Every scenario is different, and loan guidelines can vary by lender and borrower profile.

Watch the Episode (and then use this guide as your checklist)

Here’s the full video breakdown:

CTA: Want a clear plan for your numbers (down payment, closing costs, and the best loan fit)? Start here: www.theeducatedhomebuyer.com/start

Why this question is extra confusing in Orange County

Huntington Beach and Orange County are not “average” markets. Homes cost more, competition can be intense, and small differences in loan structure matter. That’s why a generic “you need X dollars” answer usually fails here.

Instead, you want to understand four buckets of money:

- Down payment (what you put toward the purchase price)

- Closing costs (lender fees, escrow/title, prepaid items, etc.)

- Reserves (sometimes required, depending on profile/property)

- Cash buffer (not required by the lender, but smart for real life)

Once you see how each loan program handles these buckets, the “how much money do I need?” question becomes far easier to answer.

The 4 minimum-down loan options that matter most

In the episode, we focus on four programs that buyers most often compare when trying to get in with a minimal down payment: FHA, Conventional 3% down, USDA, and VA. :contentReference[oaicite:1]{index=1}

Option #1: FHA (3.5% down) — flexible underwriting, but mortgage insurance rules matter

FHA is one of the most common starting points for first-time buyers. The basic guideline is 3.5% down with a 580 credit score, and it can go down to a 500 score with 10% down (although approvals and terms get more challenging as scores drop). :contentReference[oaicite:2]{index=2}

Why “automated approval” matters

One detail from the episode that most buyers don’t understand until they’re in the process: if you don’t get an automated approval, you may be forced into manual underwriting with lower allowable debt-to-income ratios and more hoops (compensating factors, reserves, etc.). :contentReference[oaicite:3]{index=3}

FHA debt-to-income flexibility

FHA is known for allowing higher DTIs than many conventional scenarios. In the episode, we discuss a structure that can allow 47% housing ratio and 57% total DTI depending on profile/approval path. :contentReference[oaicite:4]{index=4}

FHA appraisal: “stricter” doesn’t mean “deal-killer”

FHA appraisals get a bad reputation, but the real focus is safety, soundness, and obvious issues (trip hazards, missing rails, peeling paint, etc.). In the episode, we share a real example where the fixes were straightforward—repainting, trimming/clearing issues, and moving forward. :contentReference[oaicite:5]{index=5}

The big FHA “cost”: mortgage insurance (upfront + monthly)

FHA uses a split premium approach:

- Upfront mortgage insurance: 1.75% (typically financed into the loan, not paid out-of-pocket) :contentReference[oaicite:6]{index=6}

- Monthly mortgage insurance: for a 3.5% down FHA scenario, the episode references 0.55% annually (and notes how this can be attractive for lower credit scores) :contentReference[oaicite:7]{index=7}

The other “headline” FHA rule: with less than 10% down, the monthly mortgage insurance is typically for the life of the loan. There are exceptions (like 10% down, or other term/down-payment structures), but most minimal-down FHA buyers should assume it stays. :contentReference[oaicite:8]{index=8}

Practical takeaway: FHA is often a strong get-in-the-market tool—especially if your credit score is not pristine or you need more DTI flexibility. The “exit plan” is typically to refinance to conventional later if/when it makes sense and equity/credit allow it. :contentReference[oaicite:9]{index=9}

Option #2: Conventional 3% down — great for strong credit, but not always cheaper monthly

Conventional 3% down can be a fantastic option, but it has an important eligibility nuance: it’s generally for first-time homebuyers (or borrowers who meet certain HomeReady/Home Possible-type requirements), and those programs can include income limits tied to area median income. :contentReference[oaicite:10]{index=10}

Credit and pricing reality

Conventional loans typically price best when credit is stronger. In the episode, we talk through how the mortgage insurance impact can be dramatic when credit scores are lower—meaning a minimal-down conventional option may come with a higher monthly payment than buyers expect. :contentReference[oaicite:11]{index=11}

Why conventional can win long-term

The big advantage conventional has over FHA for many buyers is mortgage insurance flexibility: once you reach certain equity thresholds, the mortgage insurance can fall off (or be removed with the right process). That’s a major long-term planning advantage. :contentReference[oaicite:12]{index=12}

Orange County buyer note: Conventional often becomes more compelling when you can put a bit more than minimum down and you have a strong credit profile—because that can reduce mortgage insurance and improve the total payment picture. :contentReference[oaicite:13]{index=13}

Option #3: USDA (0% down) — powerful on paper, but extremely restrictive

USDA is the classic “zero down” program that many buyers hear about—but in Huntington Beach and most of Orange County, it’s usually not practical due to location eligibility. USDA uses a property eligibility map, and if a home isn’t eligible, it’s a hard stop. :contentReference[oaicite:14]{index=14}

USDA’s key restrictions

- Geographic eligibility: the property must qualify per the USDA map :contentReference[oaicite:15]{index=15}

- Income limits: the episode references broad household limits (example ranges cited around ~$120k for 1–4 members and higher for larger households) :contentReference[oaicite:16]{index=16}

- Housing ratio limits: the episode notes USDA’s housing-to-income ratio became more restrictive, referenced at 29% in a recent guideline change discussed on the show :contentReference[oaicite:17]{index=17}

USDA mortgage insurance: cheaper than FHA

USDA also has upfront + monthly mortgage insurance, but the episode highlights it as lower than FHA: 1% upfront and 0.35% monthly (annualized) are the figures discussed. :contentReference[oaicite:18]{index=18}

A unique USDA advantage: appraised value above price

A fascinating nuance from the episode: if the home appraises higher than the contract price, USDA may allow you to borrow based on the higher value and potentially roll certain costs in—something the episode notes other mainstream programs won’t do the same way. :contentReference[oaicite:19]{index=19}

Bottom line: If you qualify for USDA, it can be outstanding. But for Huntington Beach and most core OC neighborhoods, it’s not the go-to solution.

Option #4: VA (0% down) — the best overall (if you’re eligible)

VA is often the best loan program available to eligible veterans: zero down, no monthly mortgage insurance, and typically excellent rates. :contentReference[oaicite:20]{index=20}

VA funding fee (and when it’s waived)

VA does charge an upfront fee (similar conceptually to FHA’s upfront MI), and the episode cites a 2.15% funding fee for a first-time VA use with zero down. Importantly, the episode also notes that veterans with a 10%+ service-connected disability can be exempt from the funding fee. :contentReference[oaicite:21]{index=21}

VA underwriting flexibility: residual income

VA doesn’t rely on debt-to-income ratio the same way conventional does. The episode discusses that VA uses residual income as a key qualifier and shares a real scenario where the DTI looked extremely high, but the deal was possible due to the residual income framework. :contentReference[oaicite:22]{index=22}

Huntington Beach / OC takeaway: If you’re eligible for VA, you should almost always explore it first. It can be the difference between “waiting years” and “buying now with a sustainable payment.”

So… how much money do you REALLY need? (The practical Orange County framework)

Let’s turn all of this into a clean framework you can apply today—without guessing.

Step 1: Decide which program(s) you actually qualify for

Start with eligibility:

- VA: eligibility first (service requirement) :contentReference[oaicite:23]{index=23}

- USDA: property map + income limits + ratios :contentReference[oaicite:24]{index=24}

- FHA: credit and approval path, DTI flexibility, and MI tradeoff :contentReference[oaicite:25]{index=25}

- Conventional 3%: first-time buyer rules and pricing based on credit/income guidelines :contentReference[oaicite:26]{index=26}

Step 2: Estimate your cash-to-close

Cash-to-close is typically:

- Down payment (0%, 3%, 3.5%, etc.)

- Closing costs (varies, but it’s real money)

- Prepaids (taxes/insurance items collected up front)

Here’s the local-market reality: in Orange County, it’s common to structure deals with some form of credit strategy (seller credit, lender credit, or a rate/fee tradeoff) depending on the market and the offer. The right strategy can reduce your cash-to-close significantly.

Step 3: Compare programs side-by-side (payment, MI, and your “exit plan”)

The episode makes a point we strongly agree with: don’t choose a loan program based on a headline. Choose it based on the total math: monthly payment, total cash needed, how much home you can buy, and what your long-term plan is. :contentReference[oaicite:27]{index=27}

For example:

- If credit is lower, FHA’s mortgage insurance rate can be meaningfully cheaper than conventional MI in many cases. :contentReference[oaicite:28]{index=28}

- If you have strong credit and you can put a bit more down, conventional often wins long-term due to MI removal flexibility. :contentReference[oaicite:29]{index=29}

- If you qualify for USDA, it can beat FHA in many situations due to zero down and lower MI—but it’s restrictive. :contentReference[oaicite:30]{index=30}

- If you qualify for VA, it’s often the best overall because there’s no monthly mortgage insurance and underwriting can be extremely flexible. :contentReference[oaicite:31]{index=31}

Common myths we hear from Huntington Beach & OC buyers

Myth #1: “I need 20% down or I can’t buy in Orange County.”

Not true. There are multiple minimum-down options. The real question is whether the payment and approval path make sense.

Myth #2: “FHA is a bad loan.”

FHA is not “bad.” It’s a tool. In the episode, we highlight that it can be a great program— it’s just not right for everyone, and it’s also right for some people who assume it isn’t. :contentReference[oaicite:32]{index=32}

Myth #3: “The FHA appraisal will kill my deal.”

FHA appraisals are more safety-focused, but many issues are fixable. The episode’s real-life example shows how problems can be addressed quickly without blowing up the transaction. :contentReference[oaicite:33]{index=33}

Myth #4: “If FHA mortgage insurance is for life, it’s a trap.”

Mortgage insurance permanence is real for most minimal-down FHA loans, but the practical reality is many buyers refinance or sell before that matters. If your plan includes improving credit, building equity, and refinancing when it’s beneficial, FHA can still be a smart “bridge” into homeownership. :contentReference[oaicite:34]{index=34}

Huntington Beach and Orange County strategy: what smart buyers do differently

In high-cost markets, the winners aren’t the buyers with perfect finances. They’re the buyers who are prepared and strategic. Here’s what that looks like in practice:

1) They stop guessing and get properly pre-approved

Not a “quick pre-qual.” A real review—so the mortgage insurance, DTI, and approval engine are based on facts, not assumptions. :contentReference[oaicite:35]{index=35}

2) They choose the loan program that fits their current profile (and future plan)

The best program isn’t always the one with the lowest down payment. It’s the one that balances: approval probability, monthly payment, and long-term flexibility.

3) They build an “exit strategy” before they close

Example exit strategies:

- Buy with FHA today → improve credit/equity → refinance to conventional later (if it makes sense)

- Buy with conventional with slightly more down to reduce MI impact

- Use VA to minimize payment and preserve cash for reserves and lifestyle stability

Realistic “how much money do I need?” examples (using simple math)

These examples are intentionally simple—because your exact numbers depend on rate, property taxes, insurance, HOA, lender credits, and more. But they’ll give you a practical sense of how the “cash needed” changes by program.

Example A: Conventional 3% down

- Down payment: 3% of purchase price

- Closing costs: variable (can be offset by credits in the right scenario)

- Key tradeoff: mortgage insurance can be higher if credit isn’t strong :contentReference[oaicite:36]{index=36}

Example B: FHA 3.5% down

- Down payment: 3.5% of purchase price :contentReference[oaicite:37]{index=37}

- Mortgage insurance: upfront (1.75%) + monthly (0.55% annualized cited) :contentReference[oaicite:38]{index=38}

- Key advantage: can be a better payment path for lower credit scores compared to conventional MI :contentReference[oaicite:39]{index=39}

Example C: USDA 0% down (when eligible)

- Down payment: 0%

- Mortgage insurance: upfront 1% + monthly 0.35% annualized cited :contentReference[oaicite:40]{index=40}

- Key obstacle: map eligibility + income limits + restrictive ratios discussed on the episode :contentReference[oaicite:41]{index=41}

Example D: VA 0% down (when eligible)

- Down payment: 0%

- No monthly mortgage insurance :contentReference[oaicite:42]{index=42}

- Funding fee: cited at 2.15% for first-time use with zero down (often financed), with exemption for 10%+ disability :contentReference[oaicite:43]{index=43}

- Key advantage: residual income underwriting flexibility :contentReference[oaicite:44]{index=44}

What to do next (the fastest path to clarity)

If you’re serious about buying in Huntington Beach or Orange County, don’t make this decision off assumptions or internet averages. The right move is to map your profile to the right loan program and run the comparison side-by-side—exactly like we talk about in the episode. :contentReference[oaicite:45]{index=45}

Start here: www.theeducatedhomebuyer.com/start

We’ll help you figure out:

- Which loan programs you qualify for

- Your realistic cash-to-close range

- Your payment range (including mortgage insurance)

- The best strategy to buy now without putting yourself in a bad long-term position

Final reminder: The goal isn’t just to buy a house. It’s to buy the right way—so you can live well now and build long-term wealth over time.

Ready to start? www.theeducatedhomebuyer.com/start